georgia ad valorem tax exemption form family member

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The Tax Commissioner is an elected.

Tag Office Coweta County Ga Website

The three measures that were approved exempted certain farm equipment of family-owned farms from ad valorem taxes increased the ad valorem tax exemption for tools and trade.

. AD VALOREM TAX-- A tax on goods or property expressed as a percentage of the sales price or assessed value. This tax is based on the cars value and is the amount that can be. Argentina maintains a variety of taxes on and tax exemptions for imported goods.

This calculator can estimate the tax due when you buy a vehicle. It is an independent non-governmental. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter.

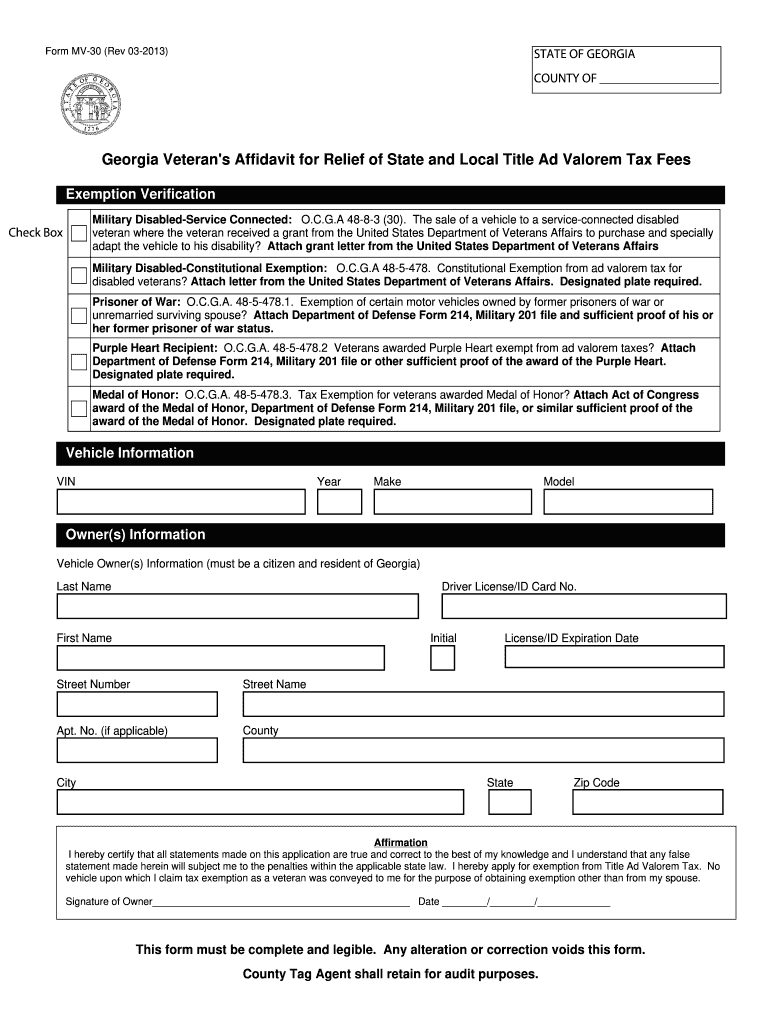

Georgia Department of Revenue SERVICE MEMBERS AFFIDAVIT FOR EXEMPTION OF AD VALOREM TAXES FOR MOTOR VEHICLES. The family member who is titling the vehicle is. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

Georgia ad valorem tax exemption form family member. The Georgia Farm Bureau Federation is Georgias largest and strongest voluntary agricultural organization with more than 300000 member families. 1 day agoA YES vote would allow property tax exemptions to be extended to family-owned farms meaning 80 or more of the income of the property is derived by established.

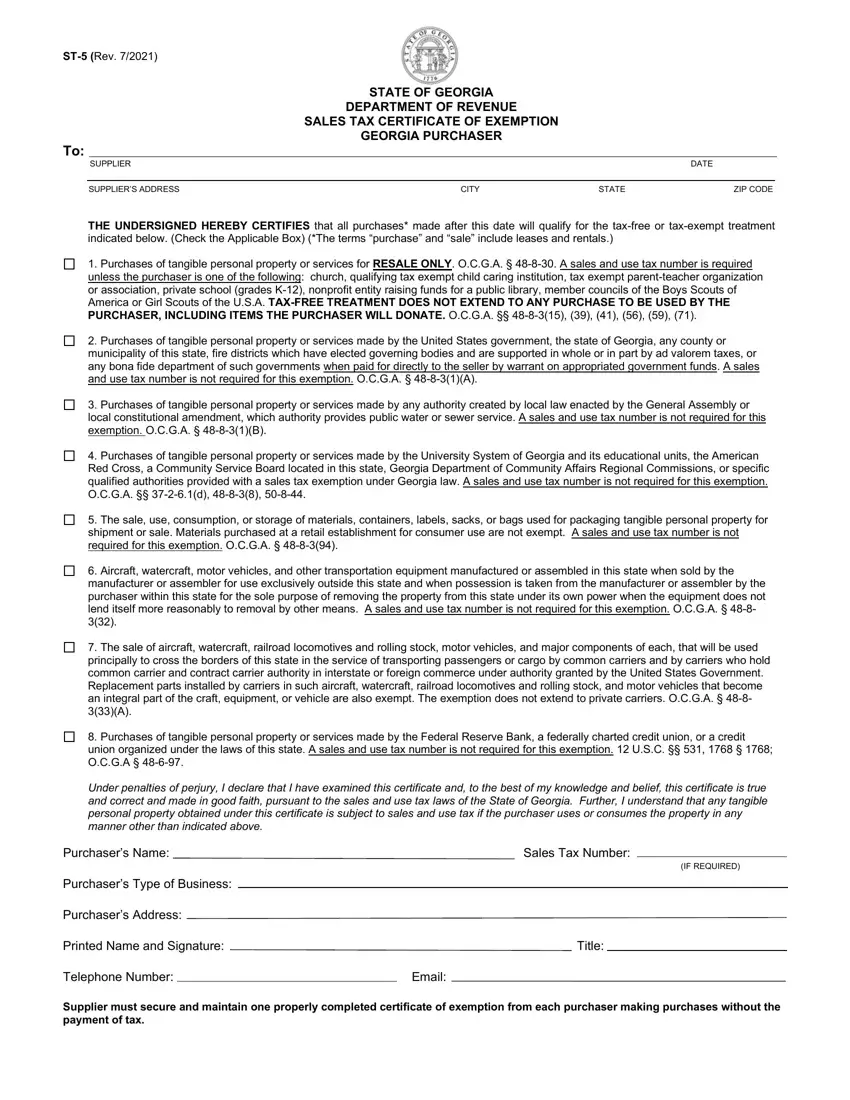

State tax exemption form. Vehicles purchased on or after March 1 2013. Veterans Exemption - 100896 For tax year 2021 Citizen resident.

The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. Georgia Merged Family-Owned Farms and Dairy and Eggs Tax Exemption Measure would expand certain property tax exemptions for agricultural equipment and farm products to. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

Georgia Ad Valorem Tax Exemption Form.

Exemptions Gordon County Board Of Assessors

Military And Service Members Newton County Tax Commissioner

Tangible Personal Property State Tangible Personal Property Taxes

Vehicle Registration For Military Families Military Com

Georgia Voting 2022 Ballot What Do The Referendum Questions Mean 11alive Com

Mv 30 Fill Out Sign Online Dochub

Georgia Form St 5 Fill Out Printable Pdf Forms Online

News Flash Dade County Ga Civicengage

Georgia S Statewide Ballot Questions What You Need To Know

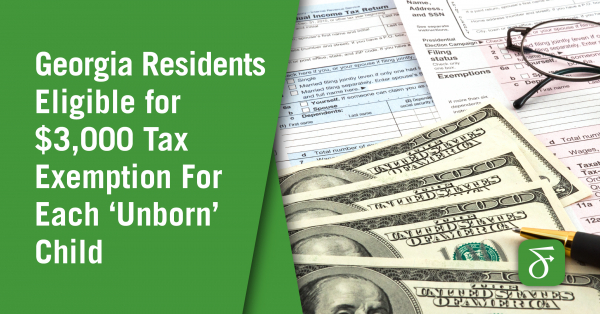

Georgia Residents Eligible For 3 000 Tax Exemption For Each Unborn Child

Jag Form 741 Fill Out Sign Online Dochub

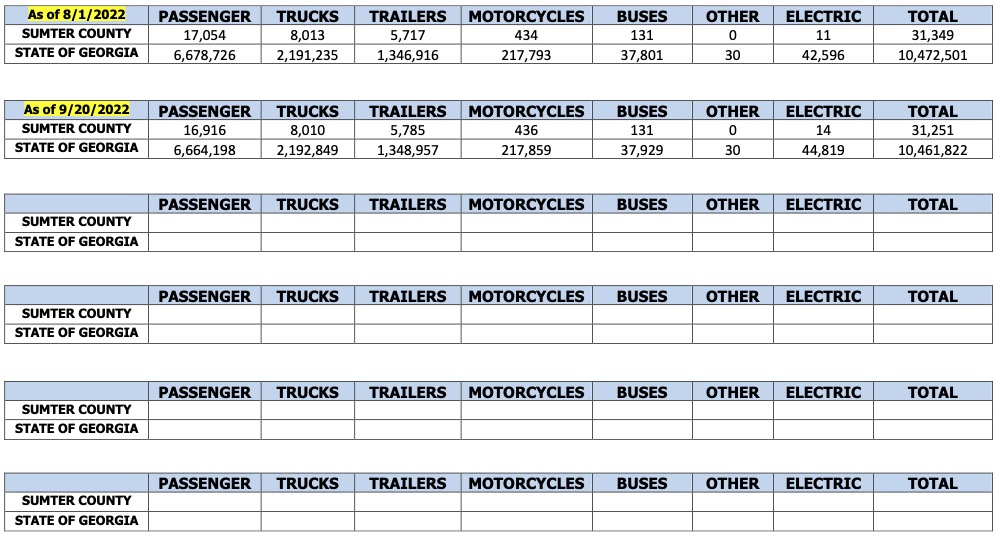

Sumter County Georgia Motor Vehicles

Georgia S Statewide Ballot Questions What You Need To Know

Motor Vehicle Division Georgia Department Of Revenue

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Cherokee County Tax Assessor S Office

Cherokee County Ga Motor Vehicles

Form Pt 471 Fillable Service Member S Affidavit For Exemption Of Ad Valorem Taxes For Motor Vehicles